The Spanish public debt 1 billion plus euros breaks records! Spanish public debt breaks records: with those 1.41 billion euros you could buy Google's parent company or several times the listed companies that make up the Ibex 35

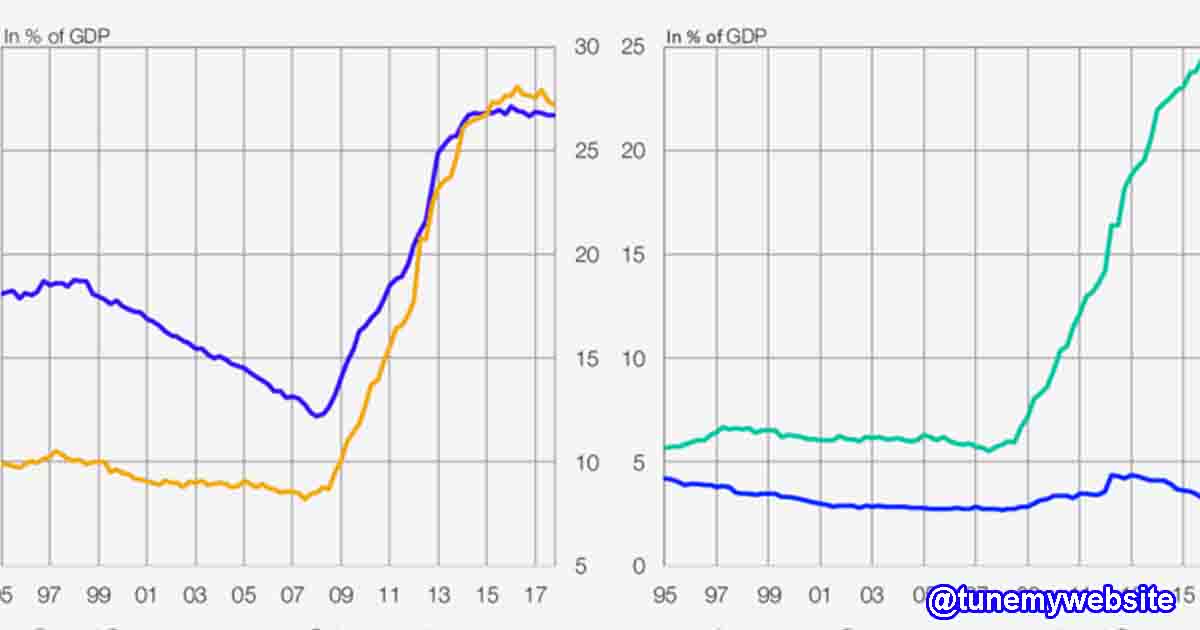

Global debt, both public and private, has been increasing inexorably for several years and experts and international institutions have warned about its growth since long before the start of the pandemic, which has further increased debt levels, especially those of the public sector, because the cost of extraordinary measures put in place to curb the impact of the crisis caused by the coronavirus has caused a debt tsunami.

Within the developed economies, Spain is among the countries that are borrowing the most to contain the consequences of the pandemic and, although it is not among the most indebted in absolute terms, it is in proportion to the size of its economy. In fact, it is among the 29 countries that exceed the public debt-to-GDP ratio of 100%, according to the International Monetary Fund (IMF).

Spanish public debt 1 billion plus euros breaks records

Spain reached a new record in March, placing the ratio of public debt to GDP at 120% after Sareb was reclassified as a state company, which was its highest debt level since 1902, although far from the 161% of GDP recorded in 1880 due to debts with foreign powers, colonial losses, the cost of the Carlist wars, industrial and railway investment and corruption scandals that led to exile of Isabel II.

According to the latest data published by the Bank of Spain, the Spanish public debt has reached its new all-time high in May, exceeding 1.41 trillion euros, while in relation to the size of the Spanish economy, the ratio to GDP once again exceeds 125% after a slight reduction during the previous month and thus returns to its highs since the end of the nineteenth century.

To better understand what this monstrous level of debt implies, we can reflect its weight per inhabitant, which implies that each of the 47.4 million inhabitants of Spain, corresponds to a debt of 30,000 euros, a figure slightly lower than the average annual income of a household in 2020.

Spanish public debt 1 billion plus euros breaks records

Geto-Dacians King Dacian state founder BUREBISTA

It can also be compared with other economic figures of great magnitude. Thus, the 1.41 billion euros reached by the Spanish public debt exceeds by more than 2.3 times the market capitalization of the companies listed on the Ibex 35, which, as shown in the chart below, add up to a total stock market value of 586,800 million euros, which is about 823,700 million euros less than the total reached by the liabilities of the general government in May.

Taking the figures of each of the companies listed on the selective Spanish, the total public debt multiplied by 15,7 the stock market value of the company with the highest capitalization of the Ibex 35, Inditex, by 21,4 of Iberdrola and to 25.7 times that of Banco Santander, in addition to more than 1,000 times the stock market value of Melia, the company with the lowest capitalization of the index.

Moving the comparison to the large multinationals listed on Wall Street, it is also possible to understand to what extent the total volume of Spanish public debt has skyrocketed in the last 17 months, in which it has come to exceed the size of the country's economy. Thus, the 1.41 trillion euros that marked the debt in May is equivalent to the capitalization of Alphabet, the matrix of Google, as reflected in this graph.

Spanish public debt 1 billion plus euros breaks records

The american company is currently the fifth-largest in the world by market capitalization, with 1,67 billion dollars (about 1,41 billion), behind Apple, which leads the standings with 2.1 billion euros; Microsoft 1,84 billion; Amazon, with 1.6 trillion; and the oil company Saudi Aramco, with 1.5 billion euros.

The stock market value of each of these great companies exceeds the Spanish public debt, which in turn exceeds the capitalization of other multinationals such as Facebook, which reaches the 899.100 million euros; Berkshire Hathaway, the investment vehicle of billionaire Warren Buffett, with 540.200 million; and Tesla, with 536.800 million; or the chinese Tencent, with 513.100 million.

Spanish public debt 1 billion plus euros breaks records

Beyond Spain, the aggregate volume of public debt accumulated by the European Central Bank, the Federal Reserve and the Bank of Japan, which exceeds the 20.3 billion euros after adding 7.6 trillion in liabilities during the pandemic, according to Bloomberg, it also reveals their enormous size when compared with the market capitalization of the largest companies and most valuable in the world.

Thus, the total debt of the 3 major monetary authorities of the world is equal to the sum of the market values of the 77 companies with higher market capitalization, among which are included the 9 companies already mentioned above alongside others such as Walmart, Nike, Netflix, Coca-Cola, Boeing, Samsung, Spotify, Sony, LVMH, Christian Dior, Johnson & Johnson or Walt Disney, among others.