US investors sell tech stocks Dow Jones 1000 points slide - Speculators dumped innovation offers and drove all US securities exchange records pointedly down after the earlier day's high note. Oil and gold additionally dropped, as examiners attempted to clarify the reason behind the auction.

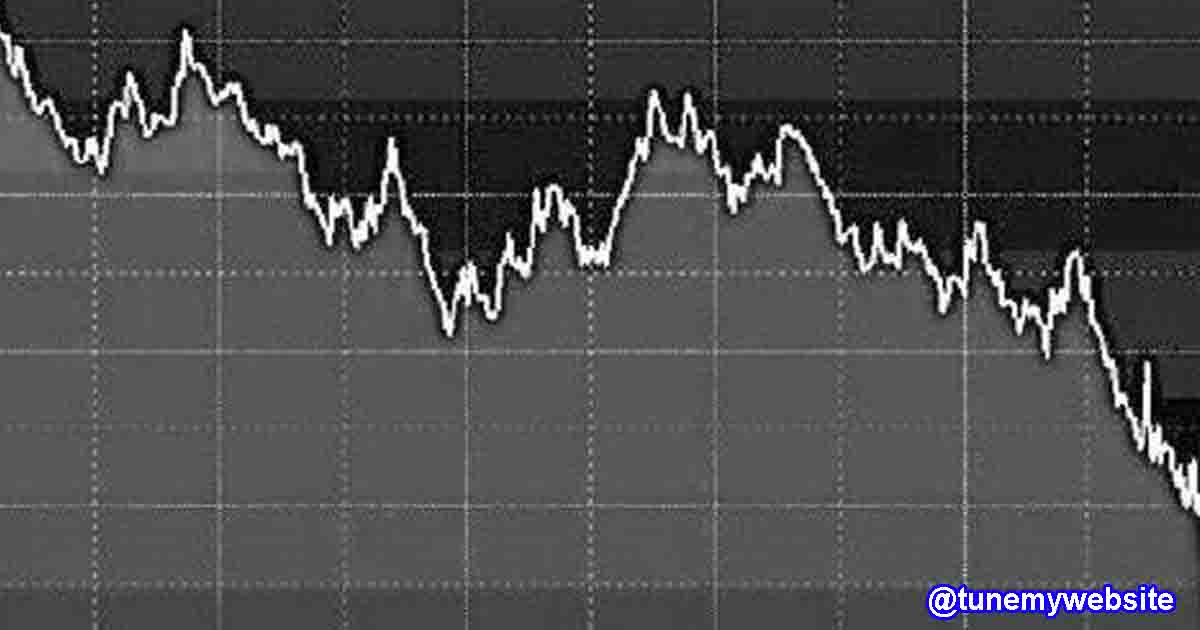

The Dow Jones Industrial Average dropped by more than 1,000 focuses before ricocheting back on Thursday, shutting down 808 focuses at 28,292.73, for a 2.8 percent misfortune. The S&P 500 dropped 3.5 percent to close at 3,455.06, while the Nasdaq composite was down five percent, at 11,458.10.

It was the most noticeably awful single-day misfortune for Dow and S&P since June, and the greatest drop for the Nasdaq since March. The decay was driven by the FAANG gathering – Facebook, Apple, Amazon, Netflix, and Google's parent Alphabet – sliding from generally high stock valuations toward the beginning of September.

In spite of the expanded dependence on PCs as the Covid-19 pandemic delays, all tech stocks got hammered. Processor creator AMD, illustrations card producer Nvidia, and even the producers of pervasive remotely coordinating programming Zoom saw their offers drop for the duration of the day.

The drop follows Wednesday's 455-point "flood" for the Dow. A Nasdaq adjustment was pretty much "reasonable," given that a large number of the organizations recorded are at "crazy valuations," David Bahnsen, boss venture official at the California-based Bahnsen Group, disclosed to Yahoo Finance.

Gold had dropped to $1,922 per ounce before moving back up during the day. Oil prospects were additionally down, with Brent unrefined at $43.15 and WTI rough at $40.22 a barrel.

"There were no significant features or evident triggers for the dive, yet it's left speculators thinking about whether the day's drop flags another notable market occasion, or only a little in-flight disturbance," Lindsey Bell, boss venture specialist at Ally Invest, disclosed.

President Donald Trump has responded to the news by recommending that the drop in business sectors has something to do with the surveys distributed by Fox News, in which his Democratic adversary Joe Biden seemed to have a lead over him in key states.

US investors sell tech stocks Dow Jones 1000 points slide

US investors sell tech stocks Dow Jones 1000 points slide

More news:

Asia-Pacific stocks slide after Wall Street's greatest dive in weeks

Australian stocks drove the misfortunes in the Asia Pacific, tumbling more than 3 percent as the area's significant securities exchanges plunged on Friday, following a gigantic tech-drove auction on Wall Street.

Japan's Nikkei 225 shut 1.11 percent down, and the Topix file declined almost 1 percent, in accordance with the misfortunes of other benchmark files somewhere else in Asia. In general, MSCI's broadest record of Asia-Pacific offers outside Japan fell around 1 percent.

In China, the Shanghai composite shed almost 1 percent, while Hong Kong's Hang Seng and South Korea's Kospi tumbled around 1.5 percent.

European business sectors resisted the pattern toward the beginning of exchange on Friday, with securities exchanges in France, Germany, and Britain up around a large portion of a percent.

The decrease in Asia came mostly in tech stocks, however the auction in Tokyo, Shanghai and Hong Kong was not as sensational as the one on Wall Street. US shares recorded their most exceedingly terrible day since June, with the Dow Jones Industrial Average falling by more than 800 focuses, or 2.8 percent. It was the greatest one-day decrease since June 11. The S&P 500 dropped 3.5 percent and the tech-substantial Nasdaq plunged 5 percent, with all tech stocks getting destroyed.

A few experts state the most recent drop is simply an adjustment after a huge tech rally during the Covid pandemic. Indeed, even with Thursday's misfortunes, Apple is still up almost 65 percent for the year, Amazon shares are up more than 80 percent, while Tesla stock has picked up around 400 percent.

US stocks were blended in the pre-market exchanging on Friday, with the Nasdaq still in negative region. Financial specialists are sitting tight for the key August positions information, which is relied upon to be delivered later in the day.

Related:

Malaysia drops criminal allegations against Goldman Sachs over plundering of state support after Wall Street bank hacks up BILLIONS

Goldman Sachs won't deal with criminal indictments over its supposed part in the burglary of billions of dollars from Malaysia's administration speculation finance, 1MDB, after the Wall Street bank consented to pay $4 billion in pay.

The bank and its units were cleared of all charges documented by Malaysia, High Court judge Mohamed Zaini Mazlan reported on Friday, as refered to by state media.

The charges were dropped after the different sides arrived at a settlement bargain following extensive talks a month ago. Under the conditions of the understanding, which permits the Wall Street bank to proceed onward from one of the most noticeably terrible embarrassments in its history, Goldman Sachs consented to a $2.5 billion money installment to Malaysia and an assurance to return at any rate $1.4 billion in resources gained with misused assets from sovereign riches finance 1Malaysia Development Berhad (1MDB). A week ago, the bank made the guaranteed $2.5 billion installment.

The reserve was set up in 2009 by Najib Razak, the then-executive, who was condemned to 12 years in prison in the wake of being sentenced on all charges identified with 1MDB. Goldman Sachs was the fundamental investor for the store and helped it to raise $6.5 billion through security deals. Notwithstanding, a significant part of the assets were abused during the cycle by government authorities and two Goldman brokers, while the bank was blamed for concealing the plundering of the country's state subsidize.

The cash redirected from state coffers was utilized to purchase everything from fine art and adornments to land and a superyacht.

The most recent improvement in the 1MDB case in Malaysia doesn't free Goldman Sachs from indictment connected to the 1MDB adventure in different nations. It is right now in converses with secure an arrangement with the US Department of Justice. It was before revealed that the bank is going to pay a multibillion-dollar fine and concede to abusing US pay off laws under the conceivable settlement.