UK strikes Japan deal first major post-Brexit free trade - While as yet fighting with the EU on the fate of its post-Brexit exchange relations, the UK has declared that it made sure about the principal post-Brexit agreement with Japan, which will make practically all British fares to the nation levy free.

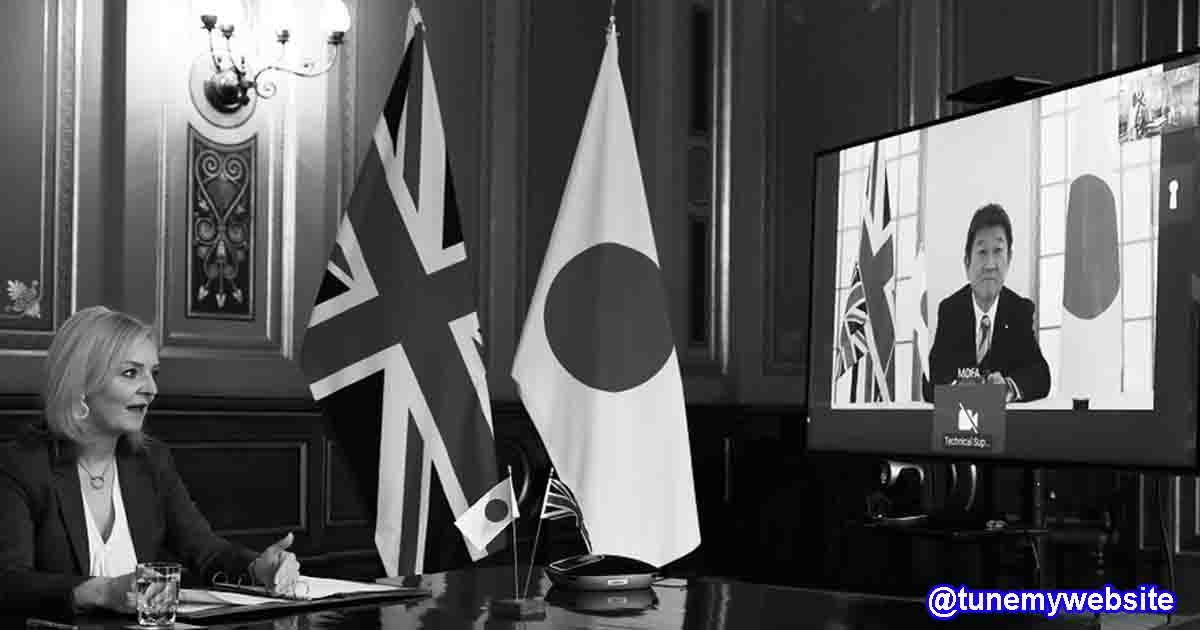

The British government declared on Friday that the UK-Japan Comprehensive Economic Partnership Agreement was concurred on a fundamental level during a video call between the UK's International Trade Secretary Liz Truss and Japan's Foreign Minister Motegi Toshimitsu.

"This is a memorable second for the UK and Japan as our first significant post-Brexit economic agreement. The understanding we have arranged – in record time and in testing conditions – goes a long ways past the current EU bargain, as it makes sure about new successes for British organizations in our incredible assembling, food and drink, and tech enterprises," Truss said in an announcement.

The arrangement, intended to support exchange with Japan by some £15.2 billion ($19.5 billion), can likewise help UK organizations increase a traction in the Asia-Pacific area as it turned into a "significant advance" towards joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The CPTPP represents around 13 percent of world GDP and is upheld by 11 nations around the Pacific Rim, and the UK has been wanting to join the alliance after the Brexit change period closes.

The UK says that homegrown makers, budgetary administrations firms, food and drink makers, just as tech organizations will profit by the duty free admittance to the Japanese market. London says that 99 percent of British fares to Japan won't be liable to levies. It additionally noticed that the UK economy will appreciate a £1.5 billion lift on account of the arrangement, while British laborers' wages may increment by £800 million "over the long haul."

England needed to look for new economic accords with its abroad accomplices as past arrangements will no longer apply from December 31, when the Brexit progress period closes. While the cutoff time is approaching, London and Brussels are as yet at loggerheads over the particulars of their respective arrangement.

The UK stoked the fire recently as it distributed the draft "Joined Kingdom Internal Market Bill." The enactment, which is in penetrate of the withdrawal bargain it concurred and marked with the EU a year ago, has gotten under the skin of EU authorities. European Commission president Ursula von der Leyen said that move "sabotages trust," while Commission Vice-President Maros Sefcovic later flagged that trust is important if chats on a future economic alliance were to proceed.

UK strikes Japan deal first major post-Brexit free trade

UK strikes Japan deal first major post-Brexit free trade

More news:

Financial specialists keep on placing cash in Russian sovereign bonds notwithstanding danger of approvals

A lot of JPMorgan's GBI-EM file, the primary worldwide benchmark for developing business sector neighborhood cash bonds, has developed to 8.3 percent, up from around seven percent two years prior and simply 1.5 percent in 2007, new information shows.

Experts state that the nation's well over a large portion of a trillion dollars of stores, a skilled national bank and moderate financial strategy make Russia probably the most grounded market, impenetrable to everything except the most pessimistic scenario sanctions. They revealed to Reuters that the new authorizes dangers won't mark the intrigue of OK two percent 'genuine' loan costs (rates short swelling) and one of most grounded open monetary records on the planet.

"What we can be sure of is that in the course of recent years since the occasions in the Ukraine occurred, the US and EU have been ceaselessly applying sanctions," said Mirabaud's head of developing business sector obligation, Daniel Moreno, including: "The inquiry is, are these approvals having any attractive impact (for the West)? I think the appropriate response is absolutely 'no.'"

Discusses the EU relinquishing the Nord Stream 2 gas pipeline, joined with falling oil costs and approaching US races, have thumped five to twelve percent off Russia's ruble, government security and value markets throughout the most recent couple of weeks.

By and by, JP Morgan information demonstrated that its customers were more put resources into Russian securities coming into the recent developments than whenever in at any rate the most recent six years.

High 'genuine' loan fees, alongside Russia's other solid basics, have assisted draw back speculators, with outsiders claiming a record 35 percent of the ruble-designated OFZ security market before the Covid-19 flare-up.

Supported by its tremendous stores of oil and gas, Russia's obligation to-GDP proportion is required to be only 20 percent this year – not exactly a fifth of that of the United States, Britain or France, and under 33% of China's.

Related:

'Hit work for short deal benefit': 'Pissed' Nikola organizer hits back at 'misleading' extortion charges that failed organization shares

Electric truck creator Nikola has vowed to move toward the US Securities and Exchange Commission (SEC) over "deluding data and obscene allegations" made in a report by short-selling firm Hindenburg Research.

In its report named "Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America," Hindenburg asserted that Nikola originator Trevor Milton offered bogus expressions about the organization's tech improvement so as to bait speculators.

Milton invalidated the claims indeed on Friday, one day after the allegation pushed Nikola stock down in excess of 10 percent. The chief said that the firm is thinking about legitimate alternatives against the short merchant and different gatherings included.

"Nikola held external insight Kirkland and Ellis LLP and approved them to connect legitimately to the SEC," he composed on Twitter. "Let's get straight to the point, Nikola moved toward the SEC, not the opposite way around. The creator needed feeling and we won't offer it to them."

"I don't have anything to stow away. Zero," he continued, including that he can't intricate the issue and promising to uncover the subtleties on when the SEC gives him the green light.

Nikola stock was down five percent, exchanging at $32.58 at the hour of composing on Friday. It was exchanging as high as $53.98 prior this week after an organization manage General Motors was declared.