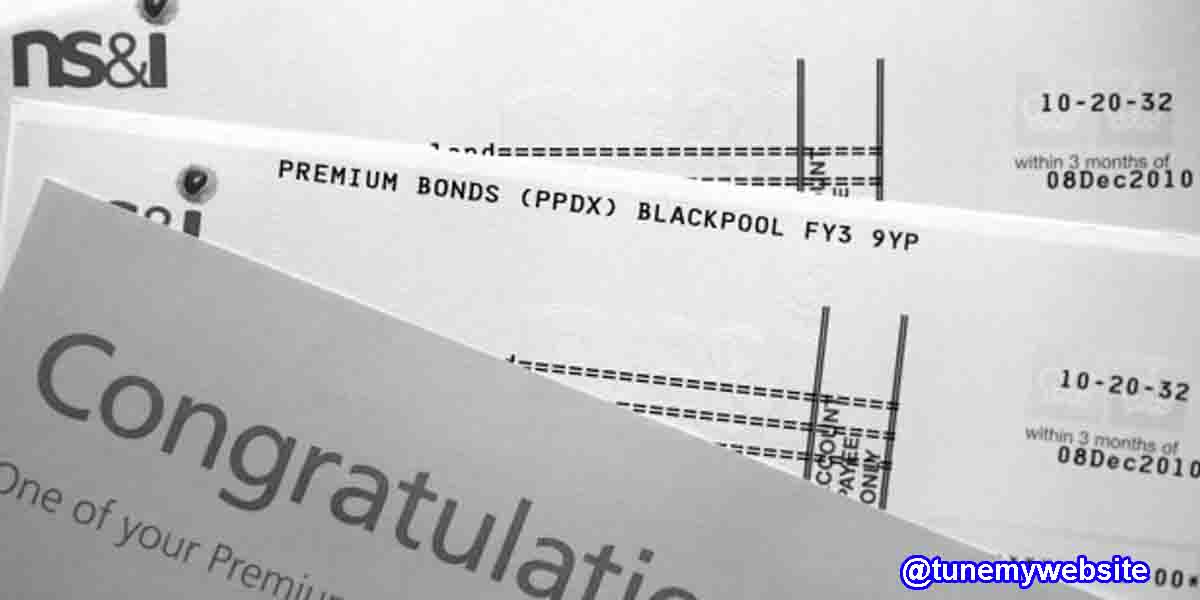

UK June Premium Bond winning numbers revealed see the champs of June's Premium Bond prize draw have been uncovered and there are two new tycoons.

One of the champs is a man from Stoke-on-Trent, who bought his triumphant bond as of late as February this year.

He has an all out Premium Bonds holding of £27,500 and his triumphant Bond number is 384CP325978.

The subsequent victor is a lady from Nottingham, who bought her triumphant Bond in January 2017.

She holds the most extreme holding of £50,000 in Premium Bonds, and her triumphant Bond number is 292ME808065.

In the June prize draw, a sum of 3,641,580 prizes worth £104,088,425 will be paid out.

There were 89,218,660,280 qualified Premium Bonds.

UK June Premium Bond winning numbers revealed

Since the primary attract June 1957, 484million prizes with an all out estimation of £20.7billion have been drawn.

The most recent prize draw comes as MoneySavingExpert has discovered that a record £1.5billion-worth of Premium Bonds were purchased in April this year.

Savers have endured falling rates as of late due to coronavirus, with the Bank of England cutting the base financing cost twice in a little while.

On the off chance that you haven't as of now, it merits checking your National Savings and Investments record to check whether you've won cash that you don't think about.

In August, there were more than 1.7million prizes worth over £64million despite everything standing by to be guaranteed by Premium Bond holders.

To check whether you're a champ, utilize the prize checker on NS&I.com, the prize check application or Amazon's Alexa.

There's no time breaking point to guarantee, so you can return to the primary Bond you bought.

Most prizes that have gone unclaimed is typically down to victors not keeping individual data, for example, a difference in address, state-of-the-art on the NS&I record.

To abstain from passing up rewards, you can decide to have any future prizes paid straightforwardly to your ledger.

So as to do this, register your Premium Bonds and NS&I accounts on the web.

UK June Premium Bond winning numbers revealed

Individuals rushing to Premium Bonds as reserve funds rates tumble, investigation finds

An extra £1.5 billion worth of Premium Bonds were gobbled up in April as investment funds rates were tumbling, as per investigation.

MoneySavingExpert.com, which did the exploration, said it was the most noteworthy number of securities purchased in one month since December 2006.

Around then, an uncommon 50th commemoration draw with five £1 million pound champs pulled in simply over £2 billion worth of bonds.

MoneySavingExpert said that for "ordinary" draws, the April complete is the most noteworthy in records returning to April 1994.

NS&I, which is upheld by the Treasury, as of late dropped plans for rate slices to Premium Bonds and a few bank accounts. Numerous different investment funds suppliers have been hacking bargains because of ongoing slices to the Bank of England base rate as a feature of crisis measures to manage the money related effect of coronavirus.

Helen Saxon, banking proofreader at MoneySavingExpert.com, recommended it is likely the additional cash NS&I is raising will be utilized to take care of the expense of the Government's coronavirus bolster plans, for example, its leave of absence and independently employed help activities.

She stated: "With numerous investment funds rates plunging as of late, and NS&I evading the pattern by dropping its arranged rate cut, it's nothing unexpected that individuals are running to Premium Bonds."

She included: "While many have been hit devastatingly hard and are battling to make a decent living, there is likewise a sizeable gathering of individuals who are acquiring their typical compensation yet can't go out and spend it as they ordinarily would. It's conceivable a significant number of these 'coincidental savers' have gone to Premium Bonds, or if nothing else added to security possessions they previously had.

"On the off chance that you do have cash to spare and you're searching for a good rate and considering Premium Bonds, it's imperative to recall that the publicized 1.4% prize rate is only a sign, and it's conceivable you could win literally nothing. Be that as it may, with investment funds grieving at exceptionally low rates, on the off chance that you're glad to take a risk, at that point Premium Bonds aren't presently a terrible spot to put your cash."