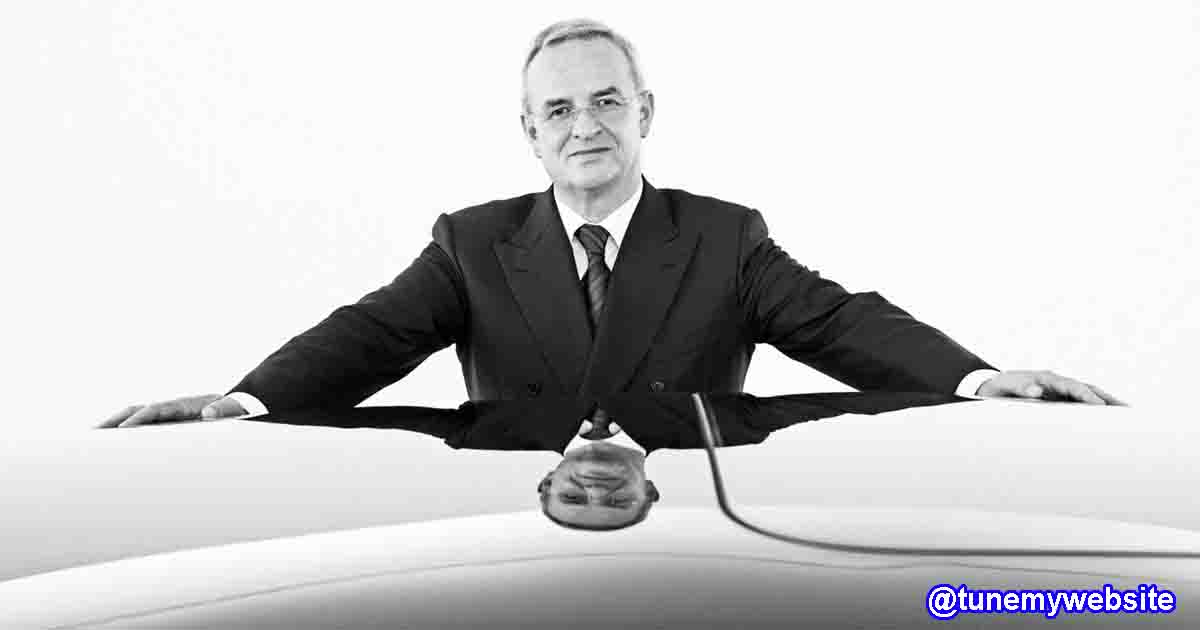

Dieselgate scandal former Volkswagen boss faces trial - The previous CEO of Volkswagen (VW), Martin Winterkorn, has been requested to show up in court to answer criminal allegations, including misrepresentation, along with a few other VW workers over their part in the long-running emanations outrage.

The German court accountable for the case reported on Wednesday it had decided "that there is adequate doubt, that is, a staggering chance of conviction, of the denounced Professor Doctor Winterkorn for business and sorted out misrepresentation."

The date of the open preliminary has not been set up until this point. Another four litigants were additionally blamed for extortion, just as genuine tax avoidance and deceitful publicizing, the court in Braunschweig said.

Winterkorn surrendered not long after perhaps the biggest outrage in the car business, named 'Dieselgate'. In 2015, Volkswagen was blamed for selling vehicles in the US that had discharges bamboozling programming. In those days the CEO rejected that he knew about the training that influenced around 11 million vehicles around the world.

After the vehicle monster confessed in the US and needed to take care of billions in punishments and remuneration to vehicle proprietors, Winterkorn was blamed by US investigators for plotting to deceive controllers over emanations. Notwithstanding the up and coming misrepresentation preliminary, the previous CEO despite everything deals with indictments over market control.

The embarrassment has just cost the German automaker more than €30 billion (US$35 billion) in punishments, legitimate expenses and remuneration installments to clients. Recently, VW arrived at a settlement with the German buyer organization VZBV over the outrage. The organization is set to pay a sum of €830 million in pay to more than 230,000 German vehicle proprietors or somewhere in the range of €1,350 and €6,257 per vehicle.

Dieselgate scandal former Volkswagen boss faces trial

Dieselgate scandal former Volkswagen boss faces trial

More news:

Russian fuel oil is a hit in US

Behind the veneer of political manner of speaking, Russia and the United States have left on an amazing demonstration of collaboration, with fuel oil turning into an uncommon exhibition of improving relations.

The issue of US-Russia vitality ties has been getting a charge out of a touch of media spotlight as President Trump blamed Democrats in New England for buying Russian unrefined to the hindrance of public monetary interests. Actually, this case is genuine just to a peripheral degree – a large portion of the Russian rough fares to the United States were truly from Kazakhstan and were just stacked onto vessels in Russia (CPC Blend). Were we to evaluate carefully crudes that start in Russia, US purifiers have taken in a simple four cargoes this year (2 Urals and 2 Varandey). However behind the exterior of political manner of speaking, Russia and the United States have set out on a great demonstration of collaboration, with fuel oil turning into an uncommon showing of commonly advantageous contact.

That American purifiers would purchase Russian fuel oil is in no way, shape or form another story, one could discover conveyances of the sort route in 2013 and 2014, yet very irregular in nature. The respective fuel oil exchange increase in mid 2018 on the rear of two significant oil market advancements – the OPEC+ unrefined creation reductions that have constrained Middle Eastern makers to diminish heavier acrid fares and the fixing of US sanctions versus Venezuela and Iran. This brought about a lot more tight flexibly to the modern treatment facilities at the US Gulf Coast, not to discuss weighty sharp rough's unmistakable appreciation. Russian fuel oil, interestingly, has not valued that much considering its generally high Sulfur content and is broadly accessible when its customary European outlets are evaporating.

The historical backdrop of fuel oil in Russia drives us back to the 1960-1970s when quickly expanding unrefined creation in the Volga-Urals locale has constrained the Soviet specialists to build its downstream limits. In those years fuel oil was broadly utilized in power age as most warm force plants were as yet designed for it (the overall changing to petroleum gas as the principle Russian age source came about later during the 1980s). Following the Soviet Union's breakdown the situation of fuel oil has debilitated again as its use in the military complex and vitality concentrated industry plunged alongside the economy of early current Russia. As a result of the above patterns, fuel oil creation has been intensely situated towards trades in the previous 20 years. In an unexpected bit of occasions, precisely when European purchasers have begun to float away from contamination inclined petroleum product, the United States showed up not too far off.

The US Gulf Coast's purifiers could be creating tremendous measures of fuel oil, as well, were they to be less refined than they are. Russia, then again, has customarily experienced a substantial error between its copious essential refining limits and insufficient optional refining limits. Under ordinary conditions a large portion of the less complex processing plants would have vanished steadily, anyway the Russian government presented an exceptional hydrocarbon tax assessment system that pretty much spared its tremendous essential treatment facility limits. The fare charge for substantial items was pegged to the cost of unrefined, setting the minimal assessment rate at 22.4% (a simple third of rough's negligible duty rate). Clearly enough this was expected to happen in a value situation where unrefined costs remain immovably underneath $50 per barrel. With unrefined costs soaring in the second 50% of the 2000s, fuel oil was experiencing its brilliant period.

This halcyon period expected to find some conclusion eventually – it was finished simultaneously by the 2014-2015 value plunge and the Russian specialists' patch up of unrefined tax assessment (additionally called as the new duty move). Strangely, the greater part of Russia's fuel oil creation originates from a modest bunch of processing plants in Northwest Russia – the Kirishi treatment facility alone delivers 6-7 million tons for every time of fuel oil, right around one-6th of the all out Russian yield. Throughout the long term the conveyance courses of Russian fuel oil have changed altogether. Prior to 2015, Baltic non-Russian ports, for example, Ventspils, Tallinn or Riga have delighted in a consistent stream from the biggest fuel oil makers yet at this point the vast majority of those courses have been closed – in addition to the fact that logistics remain confounded the Russian government has been effectively advancing (if not ordering) the "more secure" homegrown courses.

In 2019 Russian processing plants have created a sum of 285 million tons of oil items, including a still heavy 47.3 million tons of fuel oil (the unequaled high was 77.7 million tons in 2014). Of this, somewhat more than 4 million tons stayed in Russia for homegrown use and 43 million tons went for trades. Verifying the expanding job the United States' market plays for fuel oil trades, conveyances there have multiplied year-on-year in 2019 to a total of 12.6 million tons, for example practically 30% of the aggregate. The mind lion's share of Russian fuel oil fares to the US are Atlantic – there were just 7 cargoes that stacked in the Far East ports of Vanino and Nakhodka (they went to California and Washington), while an incredible 110 cargoes were provided over the Atlantic Ocean.

Given that the biggest fuel oil makers are situated in Russia's northwest, it should not shock anyone that the principle stacking ports for LSFO and HSFO are situated on the Baltic coast, with Ust-Luga accepting the prime as the primary fare terminal. On the off chance that one is to evaluate the possibilities of future fuel oil exchanging between the two countries, the likelihood of the US-Russia fuel oil sentiment finishing at any point in the near future are fairly thin. In light of the current year's exchanging volumes, the US will remain the top market outlet for Russian fuel oil (the second-biggest Netherlands has 9-10 mtpa) for an extensive time. Serving both as a bunkering and postponed coker feedstock, Russian fuel oil has displaced the inadequate Venezuelan volumes and will keep on doing so except if Latin America delivers another significant hefty sharp oil maker.

Related:

Russia's Gazprom supports petroleum gas supplies to China

Russia's flammable gas restraining infrastructure Gazprom has expanded its gaseous petrol flexibly to China through the new pipeline Power of Siberia in July and August, contrasted with June, a senior Gazprom official said.

Russia's flexibly of flammable gas to China by means of the Power of Siberia rose to 12 million cubic meters for each day in July and August, from 10 million cubic meters provided in June, Vladislav Borodin, chief general at the gas monster's unit Gazprom Transgaz Tomsk, said in the organization's corporate magazine.

Gazprom, which fired up the Power of Siberia in December 2019, hopes to expand its conveyances through the pipeline to China consistently, Borodin wrote in the magazine. Yearly supplies to China are required to ascend from 21 billion cubic meters in 2019 to 24-25 billion cubic meters toward the finish of this current year, the leader said.

In the second quarter of 2020, Gazprom's provisions to China by means of the Power of Siberia were at costs fundamentally higher than European gas costs, Alexander Ivannikov, the top of Gazprom's Financial and Economic Department, said on the Q2 phone call.

"As the volume of gas supplies under the CNPC contract develops, the Chinese market will give a more huge commitment to Gazprom's incomes and benefits," TASS news organization cited Ivannikov as saying a week ago.

Another pipeline, Power of Siberia 2, is additionally in progress among Russia and China, as Moscow hopes to hold onto a developing portion of the Chinese flammable gas market, which is required to keep on developing in the coming years, but at a more slow pace than in the past a large portion of 10 years.

Intensity of Siberia 2 entered the plan stage this year, Alexey Miller, Chairman of the Gazprom Management Committee, said not long ago.

"Obviously, this will extensively improve our capacities and will additionally encourage gas framework development all through Eastern Siberia," Miller said.